TurboTax Free Trial

by

Andreas

in Accounting

on June 4, 2025

A TurboTax “free trial” isn’t a traditional free trial in the usual sense. Instead, TurboTax offers a Free Edition that allows eligible users to file both federal and state taxes at no cost. The best part? This service is available year-round and doesn’t require any credit card information.

If you don’t qualify for the Free Edition, TurboTax will prompt you to upgrade to a paid version, with prices starting at $129. If you’re only interested in Live Tax Advice, plans begin at just $60.

Additionally, if you purchase a TurboTax Desktop product, you’re backed by a 60-day satisfaction guarantee. Looking to save more? TurboTax also has a referral program, where you can earn up to a $25 gift card for each successful referral.

Another discount you can take advantage of is the military discount. In this article, I’ll cover everything you need to know about the TurboTax free trial, including how to access it, its features, limitations, pricing, refund policy, and more. Let’s get started!

A TurboTax “free trial” isn’t your typical trial with limited-time access. Instead, TurboTax offers a Free Edition that lets eligible users file both federal and state taxes at no cost. Even better, no credit card is required to get started.

Here’s a quick table summarizing the TurboTax Free Edition details:

| TurboTax Free Edition | Details |

|---|---|

| Duration | Available indefinitely |

| Credit card requirement | ❌ |

| Hidden Charges | ❌ |

| Auto-Renewal | ❌ |

| Best For | Simple tax returns (W-2 income, standard deduction, Earned Income Tax Credit, child tax credit) |

This Free Edition is perfect for those with simple tax situations—like W-2 income, standard deductions, or eligibility for the Earned Income Tax Credit (EITC). It’s also available year-round, not just during tax season, making it convenient for early or late filers.

If your tax needs are more complex, TurboTax may prompt you to upgrade. Paid plans start at $129 and are designed for itemized deductions, home ownership, investments, or self-employment. The software guides you through every step.

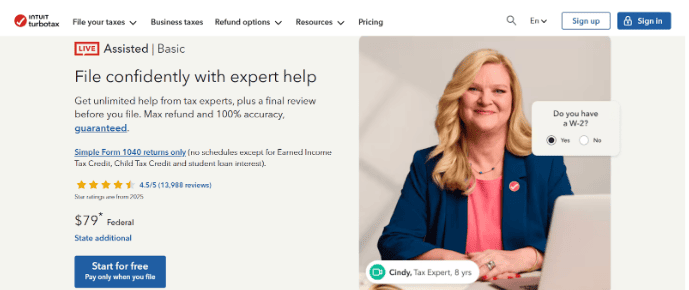

Looking for expert help? TurboTax offers Live Assisted plans. These let you talk to a real tax expert or have them prepare your taxes for you. Live advice plans begin at just $60, offering valuable peace of mind.

Prefer offline software? TurboTax’s Desktop versions let you install the program on your computer and file without the cloud. These come with a 60-day satisfaction guarantee and are ideal for those who want more control or file multiple returns.

Want to save even more? Join the TurboTax referral program. When someone files using your referral link, you could earn up to a $25 gift card per successful referral. It’s an easy way to get rewarded while helping friends save too.

TurboTax also honors military service members. Enlisted active duty and reserve members (E-1 through E-9) can file both federal and state taxes for free using TurboTax Online Free Edition or Deluxe.

I’ll talk about the pricing, refund policy and more further in the article. Stay tuned!

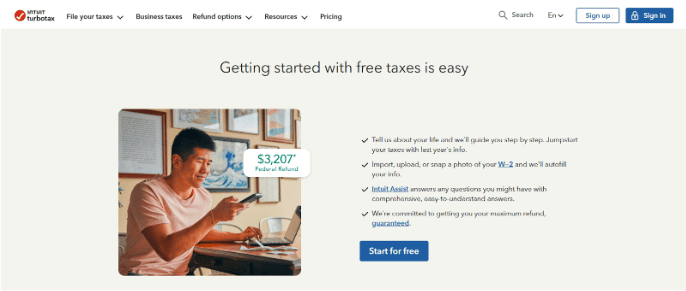

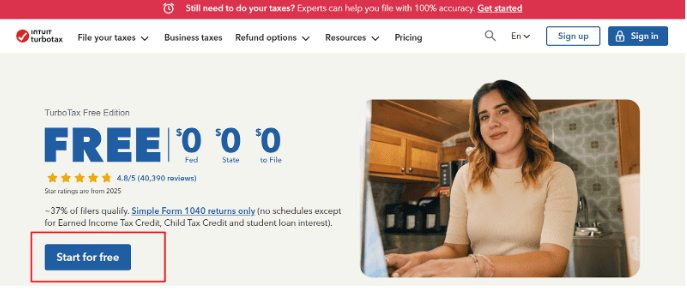

The steps to claim the TurboTax Free Edition are as follows:

Step 1: Visit the official TurboTax website.

Step 2: Click on “Start for Free.”

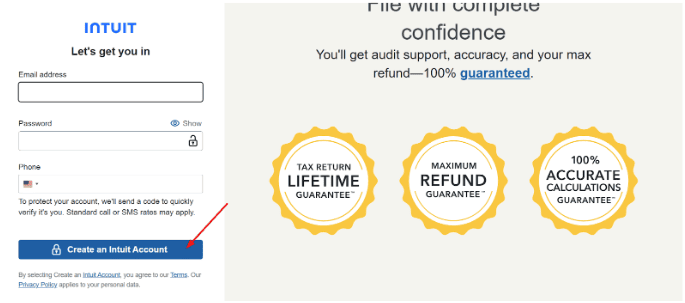

Step 3: Create your new TurboTax account using an email address, password and phone number.

Congratulations! You have successfully created a TurboTax account and logged into your Free Edition.

Here is everything you get with TurboTax’s Free Edition:

Before you file your taxes with TurboTax Free Edition, take note of these details:

Want a hassle-free tax filing with TurboTax Free Edition? Start here:

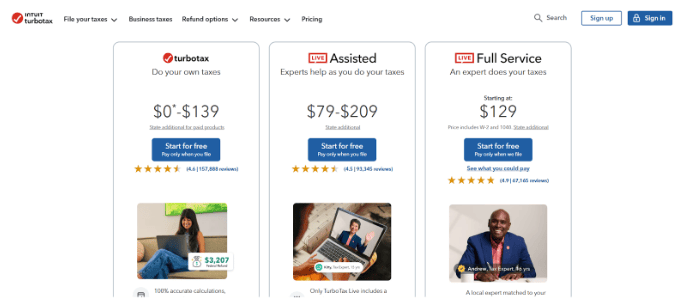

TurboTax offers a variety of plans designed to fit different tax needs, from simple returns to complex filings. Whether you’re a first-time filer or run a small business, there’s a plan that works for you without hassle or confusion.

Here’s a quick table with all the available plans and services:

| TurboTax Product/Service | Starting Price |

|---|---|

| Free Editions | $0 |

| Deluxe | $80 |

| Premier | $115 |

| Self-Employed | $139 |

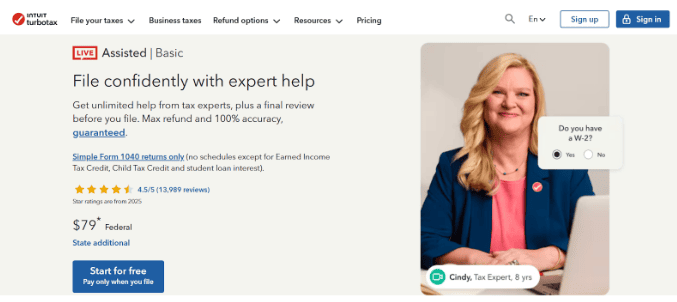

| Live Assisted Basic | $79 |

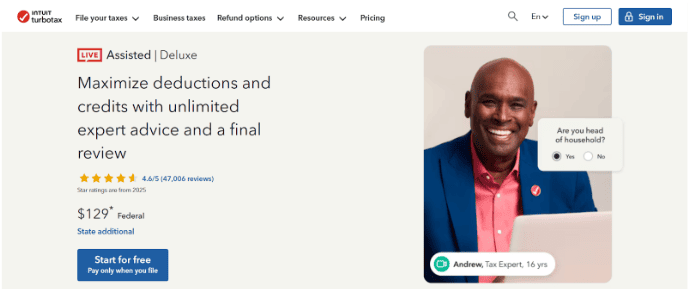

| Live Assisted Deluxe | $129 |

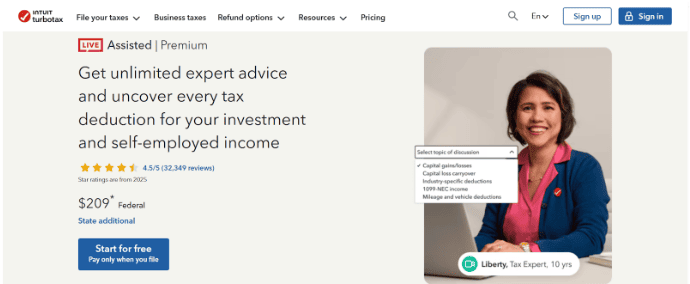

| Live Assisted Premium | $209 |

| Live Assisted Self-Employed | $209 |

| Live Full Service Basic | $129 |

| Live Full Service Self-Employed | $129 |

| TurboTax Business (Desktop) | $219 to $739 |

The Free Edition is perfect if your tax situation is straightforward. You can file both federal and state returns for free, with no credit card needed. This plan supports basic income, tax credits like the Earned Income Tax Credit, and is available year-round.

If you own a home or want to maximize deductions, the Deluxe plan starts at $80. It includes everything in the Free Edition plus itemized deductions for mortgage interest, property taxes, and charitable contributions. State filing fees apply separately.

For investors and rental property owners, the Premier plan starts at $115. It supports reporting investment income, stocks, bonds, cryptocurrencies, and rental property expenses, helping you accurately report gains and losses on your taxes.

If you’re self-employed, freelance, or run a small business, the Self-Employed plan starts at $139. This option includes industry-specific deductions, business expenses, home office, and vehicle deductions. It also guides you through quarterly estimated taxes.

Want expert help? TurboTax Live Assisted, starting at $79, lets you connect with tax experts for real-time advice. You get full access to your chosen plan, plus live support and a final expert review before filing.

Small business owners and corporations can choose TurboTax Business, beginning at $219. This plan supports S-corp, C-corp, and LLC filings and includes five federal e-files. State fees apply separately, and additional member discounts are available.

Keep in mind that state tax filings typically carry additional fees around $50 per state, except for some Free Edition cases. Also, active-duty and reserve military members may qualify to file federal and state returns for free, no matter the complexity.

Choosing the right TurboTax plan depends on your tax situation and how much help you want. From free basic filing to full-service expert assistance, TurboTax covers all needs with transparent pricing and user-friendly tools.

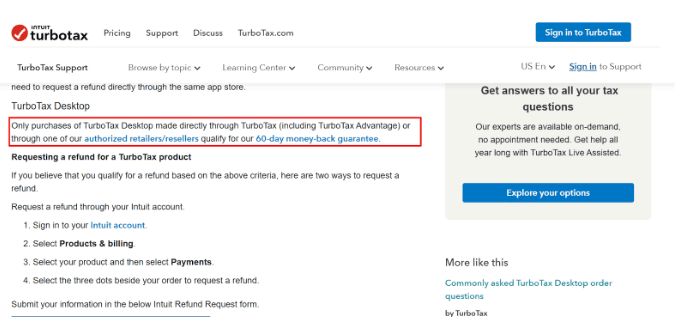

TurboTax offers a 60-day money-back guarantee on desktop software purchases. If you bought a TurboTax CD or download from an authorized retailer or directly from Intuit and you’re not satisfied, you can request a full refund within 60 days of your purchase.

This satisfaction guarantee only applies to the desktop version. It doesn’t cover TurboTax Online products, which are typically billed after you finish preparing your return. So if you’re using the web-based version, you won’t be eligible for a refund once you pay and file.

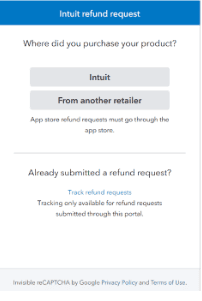

Refunds are processed through an online request form. All you need to do is fill out the official TurboTax refund request form on Intuit’s website. You’ll need your purchase details, including the order number and date, to get started with the return process.

Looking to save money on TurboTax? You have options. TurboTax offers a few good ways to score discounts on its products and services.

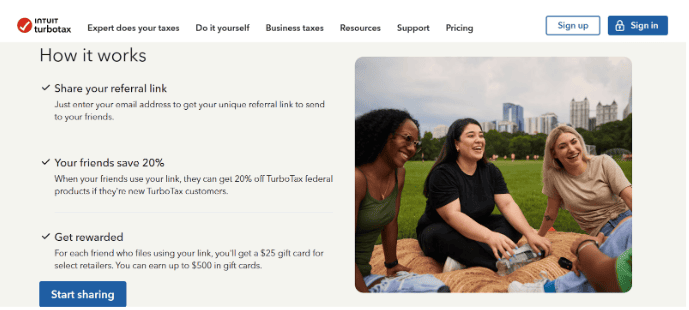

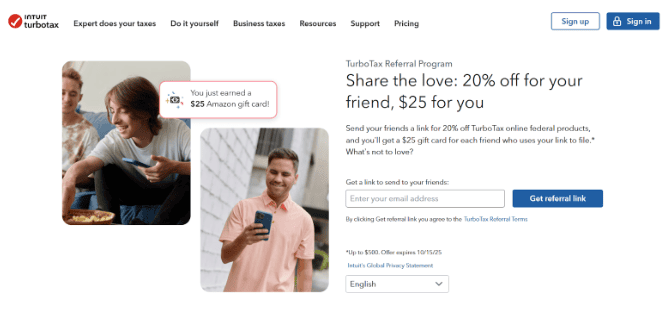

TurboTax’s “Invite-a-Friend” program allows you to earn rewards while helping your friends save on their tax filing. When you refer someone using your unique link, they receive up to a 20% discount on TurboTax federal products.

In return, you earn a $25 Amazon.com gift card for each friend who files using your link. You can earn up to $500 in gift cards per tax season. To participate, visit the TurboTax referral page and share your personalized link via email or social media.

TurboTax also offers free federal and state tax filing for active-duty and reserve military personnel of enlisted rank (E-1 through E-9) who have a W-2 from the Defense Finance and Accounting Service (DFAS). This offer applies to TurboTax Online products.

To claim this discount, start your return with TurboTax Online and enter your military W-2 information. The discount will be automatically applied when you file.

To stay informed about the latest offers, consider signing up for TurboTax’s newsletter or checking their website regularly during tax season.

TurboTax doesn’t offer a traditional “free trial,” but its Free Edition is a great option for users with simple tax needs. It allows free federal and state filing with no credit card required, plus secure, user-friendly features available all year.

For more complex tax situations, TurboTax recommends paid upgrades starting at $129 or $60 for live tax advice. Desktop users enjoy a 60-day satisfaction guarantee, while military members and referrers benefit from exclusive discounts and rewards.

From step-by-step guidance to maximum refund guarantees and mobile access, TurboTax ensures an easy, accurate experience. Whether you’re filing early, late, or somewhere in between, the Free Edition delivers unmatched convenience and peace of mind at no cost.

Ready to file your taxes the smart, simple, and secure way? Start with TurboTax Free Edition today and experience hassle-free filing with maximum refund assurance — no credit card required!

TurboTax will prompt you to upgrade if your tax situation requires additional forms or support.

You’ll need to upgrade to the Deluxe plan to claim student loan interest deductions.

As long as your return remains simple and you don’t need to itemize deductions or report investments.

TurboTax will notify you mid-process and suggest the right paid plan before you file.

For eligible users. However, some states may charge filing fees depending on your tax situation.

Free Access

June 4, 2025

June 4, 2025